Risk Mitigation

RISK MITIGATION

RISK MITIGATION

STOP LOSS

Harris Financial Solutions, Inc. along with our third-party managers incorporate Fama's and Shiller's contradictory theories in their investment approach in the stop loss model. Like Fama, markets are efficient over the long run. However, after more than 30 years of financial services experience, we recognize that investors often make choices based on emotions, not data. For those reasons our third-party managers are designed to capitalize on market efficiencies, as Fama teaches, while structured to protect against irrational human behaviors as Schiller explains. These two Nobel Prize winning economic theories are combined with the goal to capture market gains while minimizing risk.

Maximize Diversification

Effective risk management begins with strong diversification. No one knows which way the market will go, and overexposure or underexposure to any market sector can dramatically impact the overall performance of a portfolio. We invest equally over the market sectors to help protect from this risk.

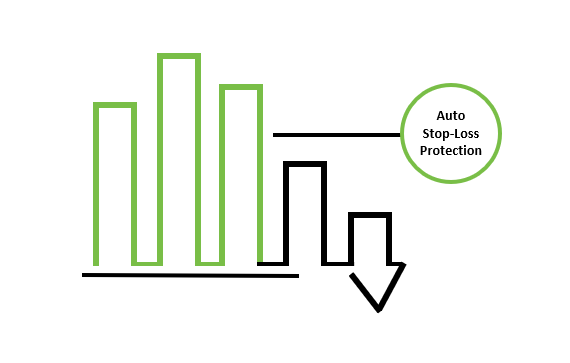

Minimize Losses

Effective risk management attempts to stop investment losses before they become destructive. For this reason we have a stop-loss strategy in place. If our proprietary index drops a predetermined amount, the stop-loss triggers and automatically sells equities within the portfolio.

Maintain Discipline

Effective risk management eliminates human emotion from the investment equation. Through our mechanical investment management approach, we maintain our discipline and react to changing markets only when our predetermined rules dictate.